3. LEVEL OF DISPOSABLE INCOME:

"The amount of money that households have available for spending and saving after income taxes have been accounted for. Disposable personal income is often monitored as one of the many key economic indicators used to gauge the overall state of the economy."

(//www.investopedia.com/terms/d/disposableincome.asp#ixzz3zHLzZtcK)

The graph shows that the disposable income in Colombia has increased during the last years and this helps our organization because it means that the customers can spend more money buying our products.

http://www.dane.gov.co/files/investigaciones/boletines/pib/bol_PIB_IVtrime13.pdf

12. WORKER PRODUCTIVITY LEVELS:

The worker productivity levels measure how productive are workers in a determined industry. It is important to know this factors to take into account that studies have shown that four Colombian workers are able to product the same as one American worker.

Based on the Monthly Report on the Labor Market from Fedesarrollo for the month of December of 2014, the indicator on workers productivity of the Colombian industry barely presented an annual arise of 2% in the first semester between the year 2008 and 2014. This affects the company in a way that to get a satisfied client it will have to operate in a faster way to be competitive and efficient.http://www.repository.fedesarrollo.org.co/handle/11445/1808

Reference: Fedesarrollo.org (Diciembre,2014). Informe Mensual del Mercado Laboral. Available in: http://www.repository.fedesarrollo.org.co/handle/11445/1808

17. DEMAND SHIFTS FOR DIFFERENT CATEGORIES OF GOODS AND SERVICES:

According to UVIC (unknown date), exist six different factors that change the demand (the prices of related goods, expected future prices, income, expected future income and credit, population and preferences).

In BottleFit company is going to occur shifts in the demand, because the price of the good and service change according as the investments that BottleFit has and also the factors listed above.

Exist two effects in the demand that the company would affront, the substitution effect and the income effect. The substitution effect is when the price of the good and service rises, people are going to search another substitutes for it, so the quantity of the demand is going to decrease. In the other hand the income effect is when the price of good and service rises relative to income, people cannot buy thing that previously they bought, so the quantity of the god and service decreases.

Reference - UVIC (unknown date), Chapter 3: Supply and demand. Available in:

18. INCOME DIFFERENCES BY REGION AND CONSUMER GROUPS:

“Rising income inequality is changing consumer spending patterns and creating substantial opportunities for adaptable businesses, although it can also undermine a country’s business environment and growth potential.” (Hodgson, 2012).

The income differences could chage and affect BottleFit income as Hodgson mention, it depends of many factors as the distribution, the geography, social clases, bussines environment and prospects.

The policies of distribution is different in each country so it is goin to affect in the transport of the product, the geography also makes difference because it depends of how far or close is the place of distribution, socai classes vary in each country so it affects as not all the people has the opportunity of buy a bottle, and finally the bussines environment increase or decrease the income being that the location of the company is important for the consumer.

Reference - Hodgson, A. (2012). Special report: income inequality rising across the globe. Available in: http://blog.euromonitor.com/2012/03/special-report-income-inequality-rising-across-the-globe.html

25. ORGANIZATION OF PETROLEUM EXPORTING COUNTRIES (OPEC) POLICIES:

Current oil price:

Brent crude, the main international benchmark, was trading at around $34 a barrel on January 29.

The American benchmark was around $32 a barrel.

OPEC daily basket price stood at $28.63 a barrel Wednesday, 3 February 2016.

Why are the prices so low?

"United States domestic production has nearly doubled over the last several years, pushing out oil imports that need to find another home. Saudi, Nigerian and Algerian oil that once was sold in the United States is suddenly competing for Asian markets, and the producers are forced to drop prices. Canadian and Iraqi oil production and exports are rising year after year. Even the Russians, with all their economic problems, manage to keep pumping.

There are signs, however, that production is falling because of the drop in exploration investments."(Krauss, 2016)

And the OPEC?

Actually, there is trouble inside the OPEC because some countries like Iran, Venezuela, Ecuador and Algeria have been pushing the cartel to stabilize the prices but Saudi Arabia, the United Arab Emirates and others are refusing to do it.

This affects our organization because the oil price is affecting the dollar price, and that's affecting our economy by making more expensive many things in the market so customers spendings decreases. Also, this affect the prices of the raw materials, the production and the transportation.

References:

-

Krauss, C. (3 de Febrero de 2016). The New York Times. Obtenido de Oil Prices: What’s Behind the Drop? Simple Economics: http://www.nytimes.com/interactive/2016/business/energy-environment/oil-prices.html?_r=0

-

Bowler, T. (2015 de January de 2015). BBC News. Obtenido de Falling oil prices: Who are the winners and losers?: http://www.bbc.com/news/business-29643612

-

OPEC. (03 de Febrero de 2016). Obtenido de OPEC daily basket price stood at $28.63 a barrel Wednesday, 3 February 2016: http://www.opec.org/opec_web/en/923.htm

26. COALITIONS OF LESSER DEVELOPED COUNTRIES (LDC) POLICIES:

Developing countries account for seventy-five percent of the membership of the World Trade Organization (“WTO”) and are increasingly able to use their power to influence negotiations traditionally dominated by developed countries. Colombia is part of Cairns Group, Friends of A-D Negotiations, Friends of Fish (FoFs), “W52” sponsors and Tropical Products.

This policies could affect different countries conomy. If it affect Colombia's economy, it will affect our organizatio either possitively or negatively.

Anon, (2016). [online] Available at: Groups in Negotation. (n.d.). Retrieved August 24, 2015, from https://www.wto.org/english/tratop_e/dda_e/negotiating_groups_e.htm

Anon, (2016). [online] Available at: http://www.harvardilj.org/wp-content/uploads/2010/09/HILJ_48-2_Rolland.pdf

Economic Forces

The economic forces affect every industry because they have a direct impact on the supply & demand, and the potential attractiveness of various strategies.

1. SHIFT TO A SERVICE ECONOMY IN COLOMBIA:

When we talk about to shift to the service economy of a country we talk about the change in the economy toward services, and how it was been passing from just manufacturing to what services offer and the impact it has economically.

Shift to the service economy has been developing and growing in the last years almost everywhere, the trend of service in industries production, employment is higher as the services require from, industries, consumer, and the society is bigger each day.

In Colombia services sectors such as restaurants and hotels represents now days the 12,1 % of the national production and have been growing, others sectors like transportation grew 2,5 % in the first semester of 2014, the agricultural sector grew 2,3 % in the same year. As we can see the services in Colombia are growing and helping the development of the country and its economy.

2. AVAILABILITY OF CREDIT:

The loan portfolio in Colombia increased 11.68% annually in October slowing down the expansion compared with the rates recorded in September and August, according to the monthly report of the Financial Superintendence of Colombia.

The expansion was driven by consumer and commercial segments and the total stock of debt placed by banks and the National Savings Fund at that date is $ 375.7 billion.

In the tenth month of the year the balance of commercial and consumer loans increased to $ 952,700 million and 1.23 billion respectively. Most of the consumer loan disbursements took place through credit cards. ((http://www.dinero.com/inversionistas/articulo/credito-colombia-crece-impulsado-consumo-aunque-desacelera/217505)

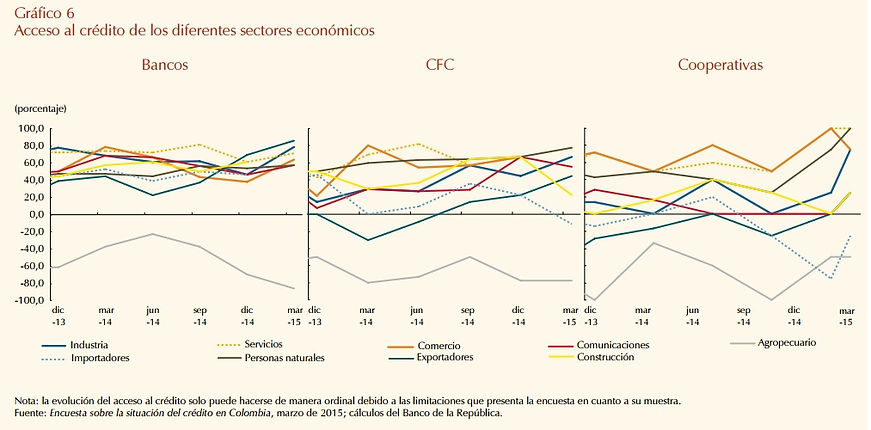

When we are going to analyze the credit access of the different sectors of the economy, we can see that the export, construction, services and industrial sectors have more credit access.

This affects our organization because this is one of the factors that determine how much money can our customers spend and in case that we need to, how much money we have access to.

Hurtado, J., Lizarazo, A., & Gómez, E. (Marzo de 2015). Reporte de la situación del crédito en Colombia. Obtenido de http://www.banrep.gov.co/docum/Lectura_finanzas/pdf/escc_mar_2015.pdf

4. PROPENSITY OF PEOPLE TO SPEND:

The average propensity to consume (APC) refers to the percentage of income that is spent on goods and services rather than on savings.

http://www.investopedia.com/terms/a/average-propensity-to-consume.asp

The chart shows that much of the spending rates on the different industries have decreased. Despite that, the transport industry has been the only one in which the consumption patterns have increased. This means that people is not spending much money in our industry.

Sources:

5. INTEREST RATES:

According to the Central Bank of the Republic of Colombia (Banco de la República, 2016) and (PORTAFOLIO.CO, 2016), the current interest rates are 6% and the main argument for its increasing is that the inflation and its expectations are the decisive factor.

This affects our organization because if the interest rates increase, the customers consumption rates will decrease because everything is going to get more expensive.

-

Banco de la República, S. M. (04 de Febrero de 2016). Tasa de intervención Banco de la República. Obtenido de http://obiee.banrep.gov.co/analytics/saw.dll?Go&_scid=oL76DXOJpSg

-

PORTAFOLIO.CO. (29 de Enero de 2016). EL TIEMPO. Obtenido de Banco de la República subió tasa de interés y la situó en 6 por ciento: http://www.eltiempo.com/economia/indicadores/suben-tasas-de-interes-al-6-por-ciento-en-colombia-banco-de-la-republica/16495066

6. INFLATION RATES:

"Inflation is a sustained and widespread increase in the price level. When this happens, money loses its value, because the value depends on the amount of things you can buy. If prices rise, money enough to buy less "(bancorep.gov.co, 2013). According to this definition of inflation in Colombia has been going this way. According to the Bank of the Republic, the inflation rate for 2015 respectively is located at 6, 67%. And it is estimated that for 2016 is 4.63%, and thus continue to decrease until a rate of 3.83% in 2017. What is call routing inflation in Colombia, focuses on increasing interest rates that from the decisions of the Banco de la Republica becomes 5.50% to 5.75%. An important factor in the current inflation has been the phenomenon of El Niño which has been tracked to accommodate the conditions followed, the price of food increased and business operations have been reduced. The Banco de la Republica aims, further increasing far as interest rates possible, in order to reduce inflation 3.83% as expected in 2017. (eltiempo.com, 2016)

CEO issuer, Jose Dario Uribe, adding that "there is a risk that the depreciation of the peso and the persistence of El Niño postpone the convergence of inflation to the target directly and by activation of indexation mechanisms "(Portfolio.co, Information DANE, 2015)

-

Bank of the Republic. (2013). What is inflation ?. 04/02/2016, retrieved from: http://www.banrep.gov.co/es/node/21896

-

El Tiempo. (2016). Railroaded inflation in the country will only be achieved within two years. 02.04.2016 recovered: http://www.eltiempo.com/economia/indicadores/inflacion-en-colombia-para-el-2016/16471289

-

Portafolio.co. (2015). In July, inflation rose 0.19 percent. 02.04.2016 recovered: http://www.portafolio.co/economia/inflacion-julio-2015-colombia-dane

7. MONEY MARKET RATES:

"A stock exchange is a facility, which can be public or private, authorized by the governments of the countries in which they are traded (bought and sold) securities such as stocks, bonds, government bonds etc. Trading in securities is done by authorized persons which are called brokers. " (bancorepcultural.org, 2015)

Colombian stocks have been severely affected by the drop in oil prices by more than 50%. This leads to a rise in the interest rate of the Federal Reserve, which causes the capitalization ratio Colcap depreciate 5.8% in 2014 and later in the 15 does not fetch this low patch. "A behavior due mainly to the deterioration of the balance sheets of the oil companies that are part of the index as Ecopetrol, Pacific Rubiales and Canacol Energy". This situation comes back with the rise of interest in the second half of 2015, generating a more optimistic scenario and corporate profits will grow. (Camilo Vega Barbosa, elespectador.com, 2015)

• Cultural Deputy Manager of the Bank of the Republic. (2015). Stock Exchange. Retrieved from: http://www.banrepcultural.org/blaavirtual/ayudadetareas/economia/bolsa_de_valores

• El Espectador. (2015). How did it go to the Colombia Stock Exchange in 2015?. Retrieved from: http://www.elespectador.com/noticias/economia/le-ira-bolsa-de-valores-de-colombia-2015-articulo-551659

8. FEDERAL GOVERNMENT BUDGET DÉFICITS:

"You have a deficit when the amount of money used at all costs in a company, in the government of a country, or a person's budget (expense) is greater than the money you receive (income); ie spend more than you have and thus presents a deficit. " (bancorepcultural.org, 2015)

According to various analysts and trade associations, the fiscal deficit oscillated between 3.1% and 3.2% of GDP for Colombia. This will lead to a slowdown of the economic cycle of the country by 0.2% and a crash by lower oil revenues. And "The Ministry of Finance projects a tax revenue of $ 116.8 billion in 2015 (US $ 46,294,000), less than the current target of $ 123.9 billion." (Dinero.com, 2015)

• Cultural Deputy Manager of the Bank of the Republic. (2015). Fiscal deficit. Retrieved from: http://www.banrepcultural.org/blaavirtual/ayudadetareas/economia/deficit_fisca l

• Dinero Magazine. (2015). Government ratifies expected: increase the fiscal deficit to 3%. Retrieved from: http://www.dinero.com/economia/articulo/proyeccion-del-deficit-fiscal-parte-del-gobierno-2015/209512

9. GROSS DOMESTIC PRODUCT TREND:

"GDP is the total value of goods and services produced in a country during a certain period of time (usually a quarter or a year); that is, the total of what is produced with the resources that have been used in the economy, valuing each final good or service at a price that is commonly handled in the market. " (bancorepcultural.org, 2015)

"From the point of view of demand, the components of GDP in the third quarter of 2015 increased by 3.4% in final consumption expenditure; 1.0% in gross capital formation and exports declined 0.7%, meanwhile imports increased 0.6%, all compared to the same quarter last year. "(dane.gov, 2015)

-

National Administrative Department of Statistics DANE. (2015). NATIONAL-GDP Quarterly Economic Accounts. 04/02/2016, retrieved from: http://www.dane.gov.co/index.php/pib-cuentas-nacionales/cuentas-trimestrales

-

Cultural Deputy Manager of the Bank of the Republic. (2015). GDP and GNP. Retrieved from: http://www.banrepcultural.org/blaavirtual/ayudadetareas/economia/pib_y_pnb

-

Colombia Stock Exchange. (2016). FINANCIAL opinion poll. 04/02/2016, retrieved from: http://www.bvc.com.co/pps/tibco/portalbvc/Home/Mercados/informesbursatiles?com.tibco.ps.pagesvc.action=updateRenderState&rp.currentDocumentID=171aed5b_1527870e643_1aab0a0a600b&rp.attachmentPropertyName=Attachment&com.tibco.ps.pagesvc.targetPage=1f9a1c33_132040fa022_-78750a0a600b&com.tibco.ps.pagesvc.mode=resource&rp.redirectPage=1f9a1c33_132040fa022_-787e0a0a600b

-

National Administrative Department of Statistics DANE. (2015) ELEMENTS OFFER AND FINALDEMAND IN THE HOMELAND 1. 02.04.2016, retrieved from: http://www.dane.gov.co/index.php/pib-cuentas-nacionales/cuentas-trimestrales

10. CONSUMPTION PATTERNS:

Expensive food and drinks have already become something usual in Colombia. "The" El Niño "announced and ongoing plaguing the country and which directly affect production costs in the agricultural sector." Although changes in the price of things change slowly, this time it has been seen drastically while the price change for goods and services consumed in Colombia. This situation mainly affects low-income individuals, and if we relate this consumption pattern with the current climate we can see the most value in different types of drinks and some products featured toilet. Sales growth of 40% in beverages, driven by developing categories such as industrial juices 109% and 127% malt growth .The first is explained by the entry of new competitors in the market with more formats large at lower prices. In this ve

in, sales in beverages have a contraction in price because households are changing their consumption habits. "This is due to the categories of development where they enter new homes that are testing several and hence boost the number of visits to the dealer," says Catalina Lopez, executive account Latin Panel. (dinero.com, 2009)

Dinero Magazine. (2009). Consumption trends in Colombia. 04/02/2016, retrieved from: http://www.dinero.com/economia/articulo/tendencias-del-consumo-colombia/76134

11. UNEMPLOYMENT TRENDS:

In 2015 unemployment stood at 8.9%, the lowest rate in the last 15 years.

During December 2015, the unemployment rate stood at 8.6% compared to 8.7% in December 2014, with an occupancy rate of 59.5%, which means that 545,000 new jobs were created in the country." (//www.dane.gov.co/index.php/mercado-laboral/empleo-y-desempleo)

"Unemployment Rate in Colombia increased to 8.60 percent in December from 7.30 percent in November of 2015. Unemployment Rate in Colombia averaged 11.82 percent from 2001 until 2015, reaching an all time high of 17.87 percent in January of 2002 and a record low of 7.30 percent in November of 2015. (http://www.tradingeconomics.com/colombia/unemployment-rate)

For BottleFit, unemployment could affect in a big way to the company’s income. This factor generates poverty in person because they are out of work and similarly do not have the opportunity to purchase products such as BottleFit. But as the table shows, Colombia reduced its unemployment rate which will be good for the country's economy and businesses.

13. VALUE OF THE DOLLAR IN WORLD MARKETS:

Companies, and everyone in a market must know that the price of the dollar has an effect worldwide and take this into account so that they are able to adapt to changes and take advantages.

Even if the Dollar is determined by a free market, there is a control system established by the bank of the republic through which the price for the currency moves. The dollar’s variation not only affects among people who negotiate with currencies, but also in every colombian’s pocket. As the price goes up, imported products get more expensive and this causes an arise on the inflation. http://www.eltiempo.com/archivo/documento/MAM-643458

That is why it is not safe that the price of the dollar arises without control, the economy's stability would be at risk. In addition to this information, the changes in the price of the dollar affects in different aspects the economy such as inflation (arise on the prices), better exports, arise on debt, among others. http://www.forbes.com.mx/por-que-un-dolar-caro-a-nadie-le-conviene/

La tasa de cambio representativa del mercado (TRM) es la cantidad de pesos colombianos por un dólar de los Estados Unidos

Actualmente la Superintendencia Financiera de Colombia es la que calcula y certifica diariamente la TRM con base en las operaciones registradas el día hábil inmediatamente anterior. http://dolar.wilkinsonpc.com.co/divisas/dolar.html

Reference: Mendoza, V. Forbes. (Enero, 2015) ¿Por qué un dólar caro a nadie le conviene? Available in: http://www.forbes.com.mx/por-que-un-dolar-caro-a-nadie-le-conviene/

El Tiempo. (2016) El dólar y sus efectos económicos. Available in: http://www.eltiempo.com/archivo/documento/MAM-643458

14. STOCK MARKET TRENDS:

Stock market trends are very variable factors, these trends change all the time so if a company wants to be successful and have profitable inversions, they must learn how these trends work and manage them in a way that they are able to take some kind of advantage out of them.

stock markets in Colombia have been losing interest since the concern about the decrease on stock prices from Ecopetrol and bankruptcy of Interbolsa. This generated mistrust on the stock market until make it inactive. http://www.eltiempo.com/economia/sectores/mercado-de-acciones-en-colombia/16095735

Reference: Garcia, C. El Tiempo. (Julio, 2015) Los colombianos se desencantaron del mercado accionario. Available in: http://www.eltiempo.com/economia/sectores/mercado-de-acciones-en-colombia/16095735

15. FOREIGN COUNTRIES ECONOMIC CONDITIONS:

Conditions in every state have an effect on the economy of others. It is important to study changes in foreign economies so that this will help us through unexpected changes.

Last year, Latin America entered into recession for the first time since the global financial crisis hit the region in 2009 with an expected contraction of 0.3%. The region’s lackluster performance was mainly the result of a deep contraction in the Brazilian economy, which is expected to have decreased 3.6%. In addition, crisis-hit Venezuela likely experienced its worst economic recession in many years, with GDP likely plunging 8.2%. http://www.focus-economics.com/regions/latin-america

Reference: Economic Forecast from the World’s Leading Economists. (January 20, 2016). Economic snapshot for Latin America. Available in: http://www.focus-economics.com/regions/latin-america

16. IMPORT/EXPORT FACTORS:

On the report from the DANE, in the month of November 2015 the external purchases decreased 20,8% with regard to the same month on the year 2014. Likewise, for the same report, the external sales decreased 32,5% with regard to November 2014.

Reference: Importaciones: Departamento Administrativo Nacional de Estadística DANE. (Noviembre,2015) Boletín técnico, Comercio exterior- Importaciones. Available in: http://www.dane.gov.co/files/investigaciones/boletines/importaciones/bol_impo_nov15.pdf

Exports: Departamento Administrativo Nacional de Estadística DANE. (Noviembre,2015) Boletín técnico, Comercio exterior- Exportaciones. Available in: http://www.dane.gov.co/files/investigaciones/boletines/exportaciones/bol_exp_dic15.pdf

19. PRICE FLUCTUATIONS:

By the EIA (2014), “Retail gasoline prices are mainly affected by crude oil prices and the level of gasoline supply relative to demand.”

The Price fluctuations affect BottleFit company because it need gasoline for the distribution of the products, if it increase, the investments are going to be bigger and the Price of the product increase, but if it decrease, the investments are less and also the Price off the product come down.

Reference - Energy Information Administration (2014). Gasoline price fluctuations. Available in: https://www.eia.gov/energyexplained/index.cfm?page=gasoline_fluctuations

20. EXPORT OF LABOR AND CAPITAL FROM COLOMBIA:

According to Procolombia (2015), “Colombia has a diverse, exportable offer that covers post-industrial products, manufacturing, clothing and services.

In the case of BottleFit, the company wants to be a very recognized Brand around the World, so it is important that BottleFit export its products to sell worldwide offering the best good and service to the consumer.

Reference - Procolombia. (2015). Colombia: A market of opportunities. Available in: http://www.procolombia.co/en/FTA-USA-Colombia/colombia-market-opportunities

21. MONETARY POLICIES:

By the Britannica (2016), “Monetary policy, measures employed by governments to influence economic activity, specifically by manipulating the supplies of money and credit and by altering rates of interest….The usual goals of monetary policy are to achieve or maintain full employment, to achieve or maintain a high rate of economic growth, and to stabilize prices and wages.”

The monetary policies affects directly the company, since it determines the economy. The money that the company pay to the goverment depends of the monetary policies in order to improve the economy`s country.

Reference - Encyclopedia Britannica. (2016). Monetary Policies. Available in: http://www.britannica.com/topic/monetary-policy

22. FISCAL POLICIES:

Colombian economy depends a lot in international oil prices, low oil prices and monetary tightening will constrain GDP growth to 2.8% in 2016 but it will pick up thereafter, helped by government infrastructure projects and private investment growth. Government sold their majority stake in national power generator ISAGEN SA for USD 2.0 billion in January in an effort to finance infrastructure modernization. Indeed, revenues of the sale are planned to be used on upgrading and expanding highways in the less-connected areas of the country. By taking this step, the government is attempting to demonstrate its commitment to fiscal discipline.

Exports were 54.8 billion in 2014, but contracted to $35.7 billion last year. The drop is partly due to a steep drop in the price of oil, Colombia’s main export product.

Colombia’s oil exports were hit hardest, plummeting 50.7% from $28.6 billion in 2014 to $14.1 billion after a major drop in global commodity prices. Coal exports, suffering from the same global price drop, dropped 33%. Part of the drop is due to a major devaluation of the peso over the past 18 months as a consequence of the dropping commodity prices. Looking back, the USDCOP gained 929.4 or 38.89 percent during the last 12 months from 2,390 in February of 2015. Historically, the Colombian Peso reached an all time high of 3399.25 in January of 2016 and a record low of 689.21 in August of 1992.

Inflation increased from November’s 6.4% to 6.8% in December, thus reaching its highest level since January 2009. As a result, inflation moved further above the Central Bank’s tolerance margin of plus/minus 1.0 percentage point around its 3.0% target. Panelists participating in the LatinFocus Consensus Forecast expect that inflation will close 2016 at 5.0%, which is up 0.1 percentage points from last month’s forecast.

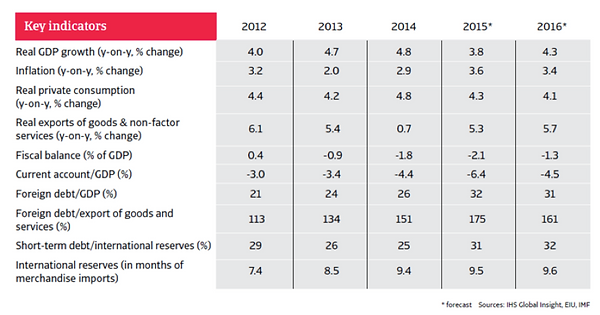

As you can see in the chart there are important issues to be taken into consideration for a company that plans to import and sell products in our country Colombia, exchange rate (USD) is critical as it has been mentioned 38,89% increase during the last 12 months, oil international prices, fiscal balance, and GDP growth forecast for this year 2,8% means a very unstable and risky economy, companies must be take decisions carefully, it is also possible that interest rate will increase but probably it is better to get debt in pesos but never in dollars.

-

http://colombiareports.com/colombias-2015-exports-plummet-32-5-due-to-low-oil-prices/

-

Colombiareports.com, (2016). Colombia's 2015 exports plummet 35% amid low oil prices and in spite of cheap peso. [online] Available at: http://colombiareports.com/colombias-2015-exports-plummet-32-5-due-to-low-oil-prices/ [Accessed 7 Feb. 2016].

23. TAX RATES:

The percentage at which an individual or corporation is taxed. The tax rate is the tax imposed by the federal government and some states based on an individual's taxable income or a corporation's earnings. The United States uses a progressive tax rate system, where the percentage of tax increases as taxable income.

S.A., E. (2014). Empresarios ganan pelea al Gobierno y logran cambios en impuesto al patrimonio. [online] Elpais.com.co. Available at: http://www.elpais.com.co/elpais/economia/noticias/empresarios-ganan-pelea-gobierno-y-logran-cambios-impuesto-patrimonio

Taking into a count that Colombia is starting a hard years from the point of view of the economist due to the dollar Price rise, and the low prices of petroleum, the government is creating different strategies to cap money and pass the possible crises, the government has announce a possible tax reform for this 2016, planning to add and raise some of the most common paid taxes such as el iva in order to collect money.

Some of the main taxes rates that could apply to our business are :

-

IVA: 16%

-

Industria y comercio : From 0,2% to 1,4% from the income of the company.

-

Renta : 25%

In Colombia iva is charged to consumers based on the Price of the service or product, this tax as the chart is showing has been constant during the last years, each showing that this tax has not cause a variation in prices lately, no clutch this tax is pronounce to be raise from 16 to 19 % this year.

Raises and changes in taxes affect our industry because prices of necessities products or services like food, light service, etc. are going to be higher and people are going to have to spend more in these necessities and are going to have less to expend in a product like ours. From the other side the raise of the tax is going to making products more expensive and less reachable.

-

Invierta en Colombia, (2016). Impuestos en Colombia. [online] Available at: http://www.inviertaencolombia.com.co/como-invertir/impuestos.html

-

Portafolio.com.co, (2016). Los ajustes que propone la comisión tributaria. [online] Available at: http://www.portafolio.co/especiales/reforma-tributaria-2016/impuestos-colombia-2016-0

-

http://www.portafolio.co/especiales/reforma-tributaria-2016/impuestos-colombia-2016-0

-

Tradingeconomics.com, (2016). Colombia Corporate Tax Rate | 1997-2016 | Data | Chart | Calendar. [online] Available at: http://www.tradingeconomics.com/colombia/corporate-tax-rate

24. EUROPEAN ECONOMIC COMMUNITY (EEC) POLICIES:

European Community (EC), previously (from 1957 until Nov. 1, 1993) European Economic Community (EEC), byname Common Market, former association designed to integrate the economies of Europe. The term also refers to the “European Communities,” which originally comprised the European Economic Community (EEC), the European Coal and Steel Community (ECSC; dissolved in 2002), and the European Atomic Energy Community (Euratom). In 1993 the three communities were subsumed under the European Union (EU). The EC, or Common Market, then became the principal component of the EU. It remained as such until 2009, when the EU legally replaced the EC as its institutional successor.

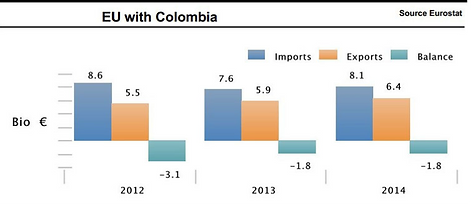

The chart above shows the importation, exportation and balance between the commercialization of Colombia an EU showing the trend that this shows over the last years, so we can understand more less the impact that this economy has on or country.